BTC Price Prediction: Bullish Momentum Intact Despite Short-Term Volatility

#BTC

- Technical Strength: Price above key averages and MACD support further upside.

- Institutional Demand: Ark Invest's Block stake and S&P 500 inclusion rumors bolster confidence.

- Risk Factors: Short-term corrections and regulatory changes may cause volatility.

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

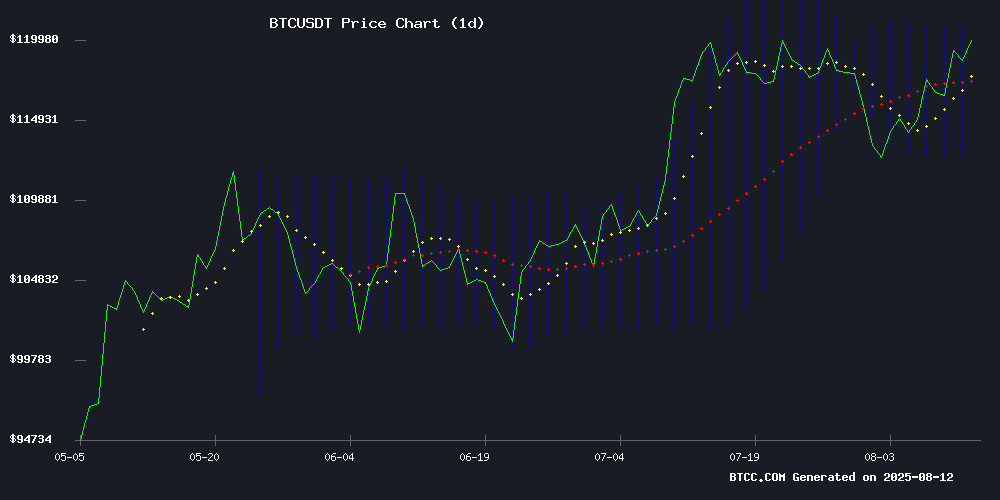

BTC is currently trading at 119,903.96 USDT, above its 20-day moving average (116,781.57), indicating a bullish trend. The MACD shows positive momentum with a reading of 1,531.08, while the Bollinger Bands suggest potential upside as the price hovers NEAR the upper band (120,945.89). According to BTCC financial analyst Robert, 'The technical setup supports further gains, with a possible test of the $140K–$148K range if key support at $118K holds.'

Market Sentiment Mixed Amid Bitcoin's Consolidation

News headlines reflect a cautiously optimistic sentiment. Cathie Wood's increased stake in Block Inc. and subdued profit-taking near record highs suggest institutional confidence. However, short-term corrections and regulatory developments (e.g., Wisconsin's KYC rules) may introduce volatility. Robert notes, 'The market is digesting recent gains, but fundamentals like Ark Invest's accumulation and CPI data support a long-term bullish case.'

Factors Influencing BTC’s Price

Cathie Wood Doubles Down on Block Inc. Amid Bitcoin Push and S&P 500 Inclusion

Ark Invest's Cathie Wood acquired 262,463 shares of Block Inc. across three funds on August 11, capitalizing on a 15% dip from the stock's recent $85 high. The investment firm now holds $169 million in Jack Dorsey's payments company, representing 1.62% of its total portfolio.

Block's strategic Bitcoin focus appears validated by its Q2 results - $1.5 billion profit marking 16% YoY growth - and recent S&P 500 inclusion. The index addition is expected to drive institutional demand and liquidity for the stock, which powers Cash App's crypto services and Square's merchant ecosystem.

"Innovative payment platforms remain undervalued," Ark stated, reinforcing Wood's conviction in Block's crypto-integrated business model. The purchase follows Block's expanding Bitcoin ecosystem initiatives, including mining developments and Lightning Network integration.

Bitcoin Profit-Taking Remains Subdued Near Record Highs

Bitcoin's rally to $122,000 has sparked only modest profit-taking, with daily realized gains averaging below $750 million year-to-date. This contrasts sharply with January's $2 billion daily profit realizations and July's spike when BTC touched its $123,000 all-time high.

Glassnode's metrics reveal long-term holders continue dominating profit-taking activity. The exception came during July's peak when short-term investors - likely those who bought March's $76,000 dip - capitalized on the tariff tantrum recovery. Current restraint suggests broad conviction among both cohorts.

Market structure appears resilient as holders resist liquidating positions despite the 5% swing from $116,000 to $119,000 this week. Such discipline during price discovery phases historically precedes extended bull runs.

Will Cloud Mining Remain Profitable in 2025? 7 Legitimate Platforms for Automated Bitcoin Rewards

Cloud mining continues to attract Bitcoin enthusiasts seeking a hands-off approach to cryptocurrency earnings. By outsourcing hardware requirements to remote data centers, users can participate in mining without upfront investments or technical expertise.

Seven platforms stand out in 2025 for their verified operations and automated payout systems. Cryptosolo leads with AI-optimized renewable energy mining and offers new users a $15 sign-up bonus. The Swiss-based platform exemplifies the sector's shift toward sustainable mining practices.

These services democratize Bitcoin acquisition while addressing traditional mining barriers like energy consumption and hardware costs. Market indicators suggest cloud mining will maintain profitability through 2025, particularly on platforms leveraging technological efficiencies.

Bitcoin Faces Short-Term Correction Before Potential Rally to $140K–$148K

Bitcoin maintains a bullish technical structure after completing a five-wave impulse, according to XForce Global. The cryptocurrency now trades at $118,721, down 2.7% over the past day but still holding a 3.8% weekly gain. Analysts interpret this pattern as confirmation of an impulsive rally rather than a corrective rebound, though short-term pullbacks remain possible.

Key support levels are emerging around the 38.2% Fibonacci retracement at $115,500, which aligns with the lower boundary of Bitcoin's short-term uptrend channel. A deeper correction could test the 61.8% Fibonacci level near $107,500. These zones represent critical confluence areas where buying interest may intensify.

The broader outlook remains constructive. Sustained price action above these support levels would keep the bullish wave count intact, paving the way for a potential advance toward the $140,000–$148,000 range.

Ark Invest Bolsters Block Stake Amid Crypto Market Slump

Cathie Wood's Ark Invest acquired 262,463 shares of Block Inc. (formerly Square) on August 11 at $73 per share, totaling $19.2 million. The purchase was spread across three funds: ARKF, ARKW, and an additional ARKF buy. Block's shares had dipped 15% from the previous week's high of $85, presenting a buying opportunity.

The firm now holds $169 million worth of Block shares, representing 1.62% of its portfolio. This move follows Block's strong Q2 results, which showed a $1.5 billion profit—a 16% year-over-year increase. The company was recently added to the S&P 500 index.

Ark Invest has been actively increasing exposure to crypto-related companies, including a recent Coinbase purchase. Block CEO Jack Dorsey continues to push Bitcoin adoption, with plans to launch a Bitcoin banking suite for small businesses through Cash App.

U.S. July CPI Shows Mixed Signals, Bitcoin Edges Higher

U.S. inflation data for July delivered a mixed picture, with headline CPI rising 0.2% month-over-month, matching expectations, while the core rate—excluding food and energy—climbed 0.3%, slightly above forecasts. Year-over-year, headline inflation held steady at 2.7%, but core CPI accelerated to 3.1%, underscoring persistent price pressures.

Markets barely flinched at the nuanced report. Fed funds futures now price a 90% chance of a September rate cut, up from 84% before the release. Bitcoin, which had been hovering near $118,500 ahead of the data, inched up to $119,000 in its wake—a muted reaction compared to traditional assets. Nasdaq 100 and S&P 500 futures gained 0.6%, while Treasury yields dipped 3 basis points.

The crypto market's tempered response suggests traders remain focused on macro liquidity expectations rather than short-term inflation noise. With institutional adoption accelerating and ETF flows rebounding, digital assets appear increasingly resilient to economic data surprises.

Bitcoin Tests $118K Support Amid Short-Term Holder Accumulation

Bitcoin hovers near $118,607, marking a 2.18% daily dip but maintaining a 3.75% weekly gain. The cryptocurrency's $2.36 trillion market cap reflects subdued trading volumes, with spot and ETF flows cooling during consolidation.

Short-term holders have aggressively accumulated 220,000 BTC since June—a 9.9% surge—though this pales against Q1's 540,000 BTC buying spree. The tempered accumulation suggests cautious optimism among newer market participants.

Wisconsin Introduces Strict KYC Requirements for Bitcoin ATM Transactions

Wisconsin lawmakers have introduced Senate Bill 386, mandating full Know Your Customer (KYC) checks for all Bitcoin ATM transactions. The bill requires government-issued photo IDs for every transaction, imposes a $1,000 cap, and obligates operators to collect additional personal data. This move aligns with broader state efforts to tighten cryptocurrency regulations, citing concerns over fraud and terrorism financing.

Bitcoin ATM operators now face heightened compliance costs, potentially squeezing smaller businesses. Users, meanwhile, will encounter reduced anonymity and more transactional friction—particularly those relying on ATMs for larger sums. Wisconsin follows states like New York, where the BitLicense program has already created a patchwork of state-level crypto regulations, complicating nationwide compliance.

Is BTC a good investment?

BTC presents a compelling investment case based on current data:

| Metric | Value | Implication |

|---|---|---|

| Price vs. 20-day MA | +2.67% above | Bullish trend |

| MACD | Positive crossover | Upward momentum |

| Bollinger Bands | Near upper band | Potential breakout |

Robert highlights, 'Dips toward $118K could be buying opportunities, with a $140K–$148K target feasible in the medium term.'